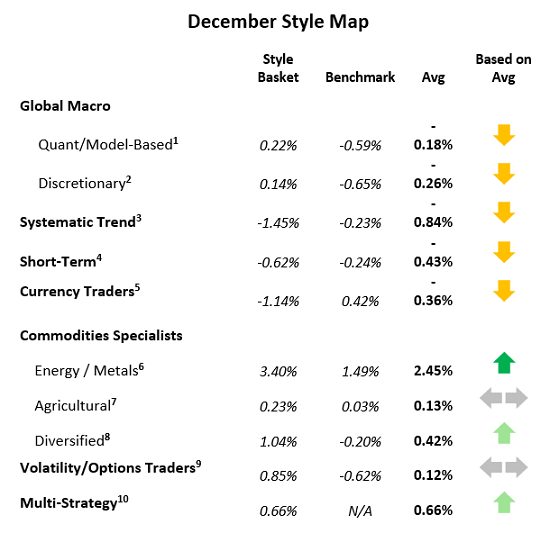

Kettera Strategies Heat Map - December 2022

Industrial Commodities – Energy and Metals Specialists

Industrial specialists were positive in December, led by strong returns in energy trading, particularly nat gas traders with short-biased exposures. Most used relative value/calendar spread to reduce the volatility in day-to-day trading. Metals specialists using fundamental inputs were positive overall as precious metals rallied on macro developments, led by gold and silver. Key base metals also rallied, namely iron ore, tin and to a lesser extent copper. Long futures, long-biased spreads, and options strategies were also profitable.

Systematic Trend Programs

Systematic trend strategies were mixed and ultimately negative, with old trends ending/ended, and no new trends to replace them, with notably choppy markets in equities, fixed income, and (to some extent) crude oil. It is difficult to pinpoint clear sector winners and losers, but equities were generally negative on long exposures in the US and Europe, fixed income and short-term rates were positive on short positioning in Europe and the U.S., and commodities were mixed across agricultural grains, the energy complex, and base metals. Many programs also saw setbacks in FX, particularly the longer-term programs that have stayed long USD vs the major currencies. Most programs were positive, however, in precious metals, especially long gold and silver positioning.

Discretionary Global Macro Programs

The discretionary macro sector appeared to be mixed, but negative in the aggregate. Profitability depended on portfolio concentration and market selection. The specific programs that Kettera follows were up slightly overall, with good performance in short equities, short USD, and long gold exposures - only partially offset by losses in crude exposures and commodities in general. More broadly, many of these programs took hits in their currency positions, particularly during the sharp mid-month reversal in the USD/Japanese Yen, with additional losses in the commodities sector. Short fixed income and rates exposures in Europe and the US were a common theme that was profitable for most programs.

Agricultural Commodities Specialists

Grain markets were mixed with corn, soybeans and soy-meal up on the month with the majority of the rally driven by adverse weather in Argentina. Wheat was choppy and range-bound, and soybean oil was sharply lower as U.S. regulations did not increase biofuel requirements. However, managers with directional (and long-biased) spreads in soybeans and soymeal appeared to reap gains. Softs trading was slightly positive for those managers we track, with short positions exploiting continued weakness in coffee offering rewards. Cattle rallied and rewarded programs with long directional and long-biased bull spread exposures, due to growing supply shortages in beef foreseen over the next 6 months.

Currency Specialists

FX programs were all over the map in December, where performance depended on strategy and time frame. Short-term systematic programs were able to catch the sharp reversal in USD vs. the Japanese yen, and to a lesser extent the Euro. Slower moving systematic programs were caught long USD and therefore were largely negative. Discretionary programs also tended to rely on timing: Those managers with shorter-term strategies were also slightly positive, while longer-term discretionary programs dependent on fundamentals were surprised by the USD turnaround, particularly after the unexpected announcement by the Bank of Japan mid-month to widen its Yield Curve Control band, thus making the yen relatively more attractive with higher interest rates.

**********

Footnotes:

For the “style classes” and “baskets” presented in this letter: The “style baskets” referenced above were created by Kettera for research purposes to track the category and are classifications drawn by Kettera Strategies in their review of programs on and for the Hydra Platform. The arrows represent the style basket’s overall performance for the month (e.g. the sideways arrow indicates that the basket was largely flat overall, a solid red down arrow indicates the basket (on average) was largely negative compared to most months, etc.). The “style basket” for a class is created from monthly returns (net of fees) of programs that are either: programs currently or formerly on Hydra; or under review with an expectation of being added to Hydra. The weighting of a program in a basket depends upon into which of these three groups the program falls. Style baskets are not investible products or index products being offered to investors. They are meant purely for analysis and comparison purposes. These also were not created to stimulate interest in any underlying or associated program. Nonetheless, as these research tools may be regarded to be “hypothetical” combinations of managers, hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any product or account will achieve profits or losses similar to those shown. in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. one of the limitations of hypothetical results is that they are generally prepared with the benefit of hindsight. in addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. there are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results..

Benchmark sources:

1- Blend of Hedge Fund Intelligence Global Macro Index and Eurekahedge Macro Hedge Fund Index

2- The Hedge Fund Intelligence Global Macro Beta Index: (same link as above)

3- The Societe Generale Trend Index

4- The Societe Generale Short-term Traders Index: (same link as above)

5- The Eurekahedge AI Hedge Fund Index

6- The Barclay Hedge Currency Traders Index

7- Blend of Barclay Discretionary Traders Index and Bridge Alternatives Commodity Hedge Fund Index

8- The Barclay Agricultural Traders Index: (same link as above)

9- The Barclay Fixed Income Arbitrage Index: (same link as above)

10- Blend of Eurekahedge Relative Value Volatility Hedge Fund Index and Eurekahedge Long Volatility Index

11- Blend of Eurekahedge Asset Weighted Multi Strategy Asset Weighted Index and Barclay Hedge Fund Multi Strategy Index

12- Eurekahedge Event-Driven Hedge Fund Index

13- The Barclay Hedge Crypto Traders Index

Indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. index data is reported as of date of publication and may be a month-to-date estimate if all underlying components have not yet reported. the index providers may update their reported performance from time to time. Kettera disclaims any obligation to verify these numbers or to update or revise the performance numbers.

***

The views expressed in this article are those of the author and do not necessarily reflect the views of AlphaWeek or its publisher, The Sortino Group

© The Sortino Group Ltd

All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or scanning or otherwise, except under the terms of the Copyright, Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency or other Reprographic Rights Organisation, without the written permission of the publisher. For more information about reprints from AlphaWeek, click here.